In the wake of a historically dreadful shooting in New Zealand, one of the statistically safest countries in the world, you would be forgiven for thinking that financial markets would be reeling from the horror of seeing 49 people gunned down.

NZ is not the United States in terms of gun violence – the last time that more than ten people died in a shooting was 1990, nearly 20 years ago. Instead, there was an apparent bout of risk-on, with major US indices like the Dow Jones and Nasdaq rising sharply on the day.

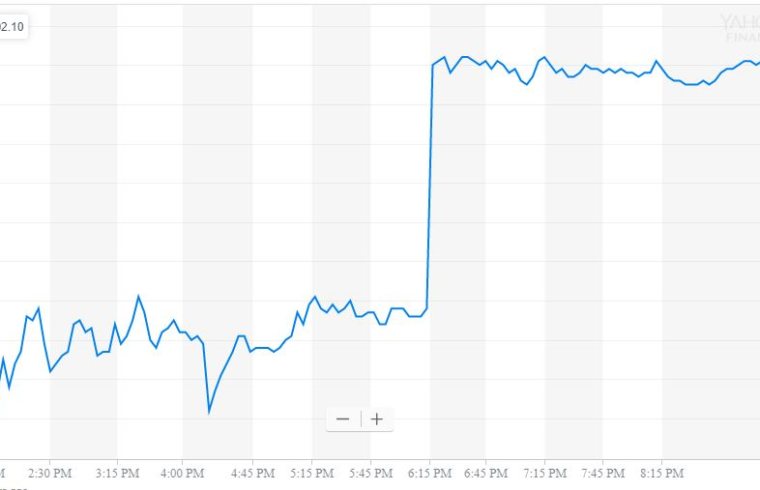

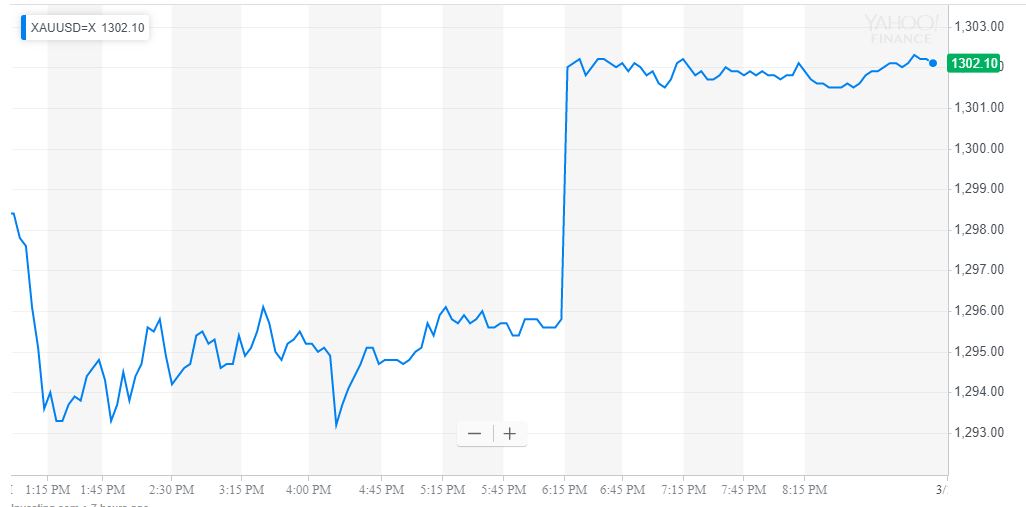

One area where analysts did believe the terrorist attack had an impact was in the gold price, with a couple of reports suggesting that the bounce back above $1,300 was a direct result of the massacre.

Join CCN for $9.99 per month and get an ad-free version of CCN including discounts for future events and services. Support our journalists today. Click here to sign up.

Analysts: New Zealand Shooting Sent Gold Price Higher

Analysts said that the New Zealand terrorist attack launched the gold price above $1,300. | Source: Yahoo Finance

First, Chintan Karnani, chief market analyst at Insignia Consultants, said:

“New Zealand news is positively supporting gold, Brexit uncertainty is also supporting gold prices.”

Next, Naeem Aslam, strategist at ThinkMarkets UK, said:

“The attacks over in New Zealand has stunned the markets; Investors are seeking shelter under safe haven assets.”

New Zealand Terrorist Attack Wasn’t Gold’s Primary Driver

Well, I’m sorry to be unkind, but that is very much not the case. Perhaps there was a small amount of temporary noise from the terrorist attack, but this was a tiny fundamental. You have to look at correlations between asset classes to gauge what is moving the markets.

Today, we saw higher stocks, higher metal prices, a weaker dollar, and lower oil prices. All these issues point to falling yields in bonds, nothing more.

Gold might like chaos, but it loves a weaker USD more, mainly because it trades around the world in dollars. What may have confused some investors was seeing the haven Japanese yen (JPY) rising against the dollar.

However, looking at a cross-section of G10 currencies, it is evident that the moves are almost identical in USD denominated majors. This eradicates the argument for haven flows.

Dow Futures Boom as Trump Admin Clambers to Rescue China Trade Deal https://t.co/hVbinqcqSh

— CCN.com (@CCNMarkets) March 15, 2019

Other than stock markets, the Australian dollar was telling the real story. Up 0.35% against its US counterpart, the Aussie was solidifying that Friday was about China developments and nothing else. The New Zealand dollar, of all the currencies, should have been lower, but it too rose.

Domestic Terrorism Has Less and Less Impact on Financial Markets

I wish financial markets still cared about domestic terrorism, but they just don’t. New Zealand, France, the UK, and America are all suffering from high terror alerts, but local stock markets barely blink. Even the world-changing 9/11 attack stock losses were erased within a few months, as noted by Gideon Rachman writing for the Financial Times:

“In the first week of trading after the terror attacks of September 11, the Dow Jones fell 14 per cent. But the Dow and the Nasdaq recovered their pre-9/11 levels within months of the attacks.”

Why is this the case? Well, It could be because machines do most of the trading and the decisions are less emotional. Mr. Rachman makes a compelling example of this from another quote where he questions whether political risk affects a billionaire’s investment outlook:

“I was having coffee with one of the other speakers, a celebrated private-equity investor, and asked him how much he thought about geopolitical risk. ‘Hardly at all,’ he replied. ‘We look at the companies, the cash flows, the investments themselves.’”

Gold is a Commodity, Not a True Haven

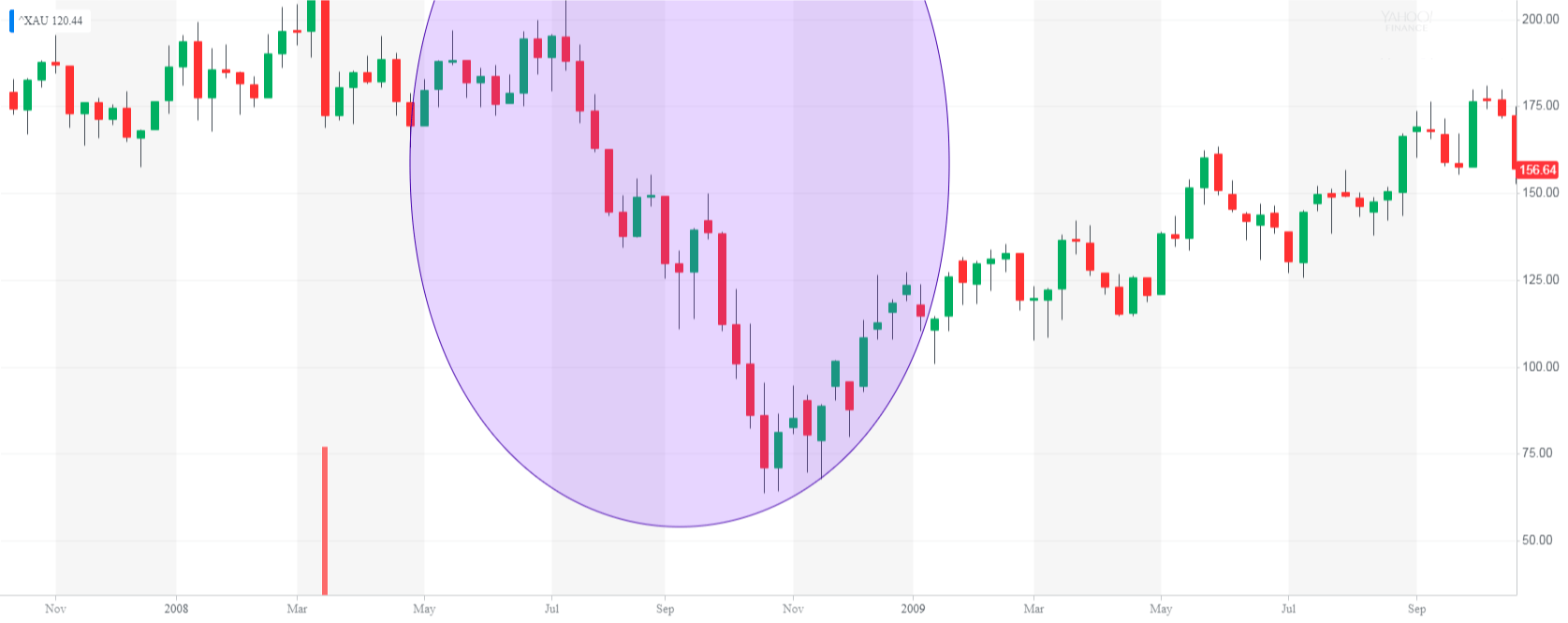

I can go further in looking at how gold behaves more as a commodity than a haven. If you look at the height of financial turmoil in 2008 when it looked like the world was ending, gold fell in value along with everything else.

Gold was a terrible investment during the Great Recession. It only firmed when the Fed restored business sentiment by cutting rates and increasing the monetary base. | Source: Yahoo Finance

People incorrectly look at its subsequent rally as fear-based, but it was really because gold loves low interest rates and tends to drop when interest rates move higher. Even that correlation is struggling of late.

I love that gold drops and equities pop when ECB announces TLTRO-III.

The scenario the gold bugs ‘feared’–massive, reckless, aggressive, global CB intervention–happened over the past decade, yet every asset EXCEPT gold has risen in price. #TakeTheHint #DyingAsset

— Dow (@mark_dow) March 7, 2019

Take a look at the CFTC COT report, and the smartest money in the gold business continues to hedge against depreciation in the price. Commercials have been majority short sellers of gold for many years now. In fact, hedging, in general, might be the best use of gold rather than an investment.

New Zealand Should Have Had an Effect on Haven Demand

I wish that markets were more fearful of domestic terrorism like we saw in New Zealand; it might go some way to sparking politicians into really addressing the implications of their actions.

Unfortunately, to suggest that gold was seeing extra demand because of a mass shooting in an isolated economy is just flat-out incorrect.

Disclaimer: The views expressed in the article are solely those of the author and do not represent those of, nor should they be attributed to, CCN.