The bitcoin price took another dive on Wednesday, slipping below the $3,700 mark after trading within a tight window for several days.

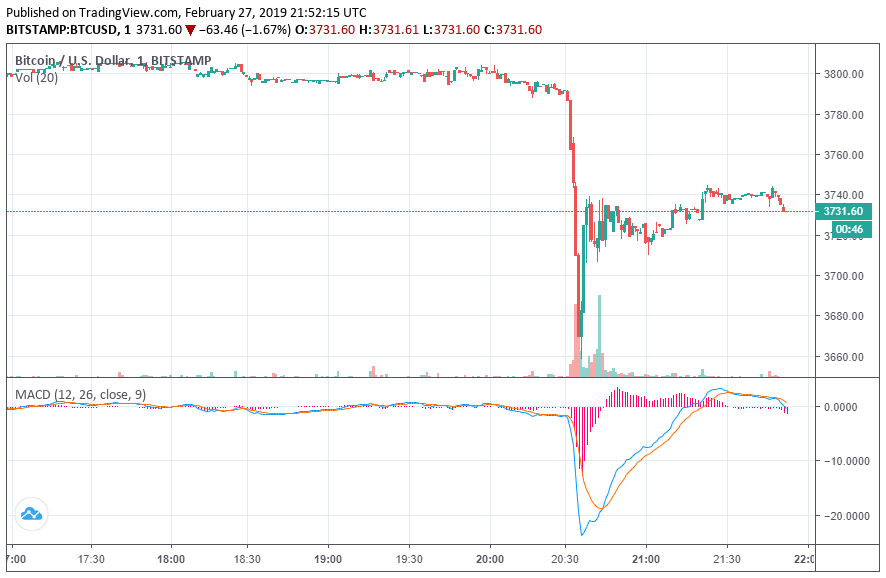

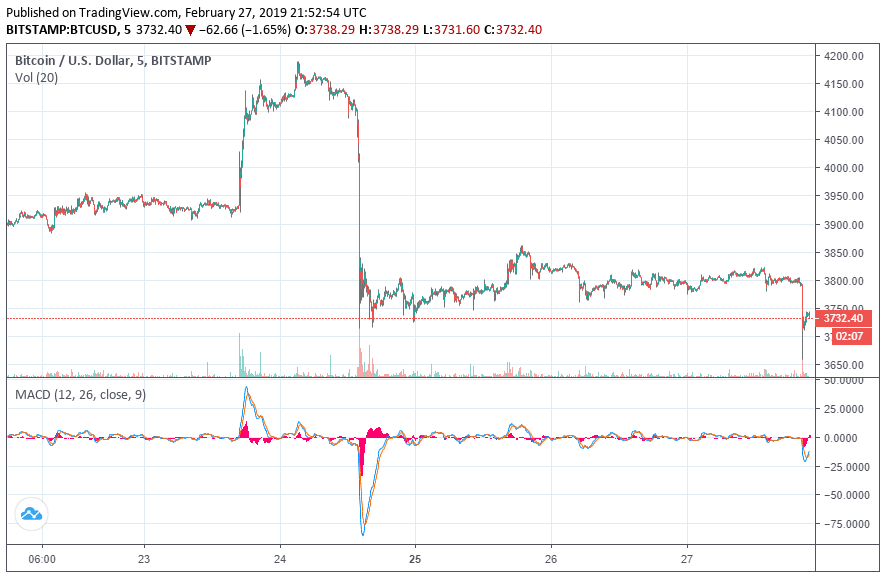

Bitcoin had bounced around the $3,800 mark for most of the day but dipped below it shortly before 14:00 UTC. Six hours later, the flagship cryptocurrency experienced a sharp drop that carried it from $3,795 to $3,658 within a matter of minutes.

That move took the bitcoin price to its lowest price since Feb. 18 and represented a 13 percent pullback from its Sunday high of $4,190. The cryptocurrency is currently trading at $3,731 following a moderate recovery.

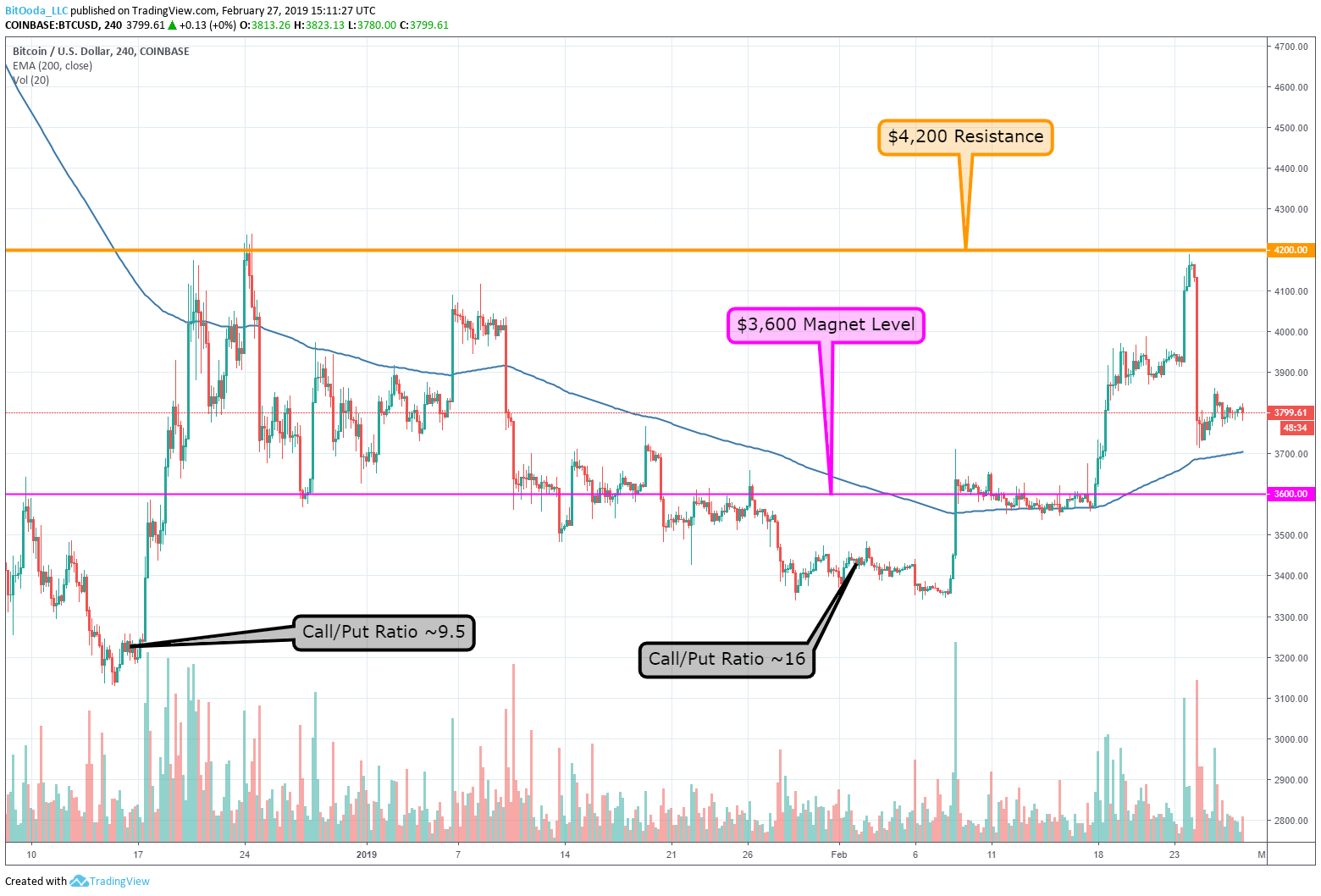

Bitcoin has not yet crashed through any crucial support levels, but today’s pullback has placed a bull market even further out of reach. The cryptocurrency faces strong resistance at $4,200, and most analysts have pegged $5,000 to $6,000 as the level that it must reach to truly exit its prolonged bear market.

Bitcoin has moved back toward its magnet level at $3,600 and is now nearly $500 away from resistance at $4,200. | Source: BitOoda

Crypto broker BitOoda had earlier in the day warned clients that the options market did not forecast a near-term rally, as the call/put ratio – a simple measure of the number of call options being traded relative to put options – stood at just 1.95. By contrast, the call/put ratio spiked as high as 16.17 on Feb. 2 as the bitcoin price prepared for its almost month-long surge.

BitOoda concluded:

“As for now, through this analysis, we seem to be stuck in this $3,200-$4,200 range and therefore remain BEARISH. The ‘trend is our friend’, and will stick to this outlook until forced to do otherwise.”

Click here for a real-time bitcoin price chart.

Featured Image from Shutterstock. Price Charts from TradingView.