Goldman Sach’s Chief Economist Jan Hatzius points to the global economy having missed a bullet, the threat of recession might just be over. Though growth is slow, Goldman’s activity indicator for February shows an increase compared to the December and January data which prompted many to call “recession.”

Green Shoots May Mean the Global Economy is on its Way Back Up

One of the most recent harbingers of global financial doom is George Maris of asset management firm Janus Henderson. Maris says a recession is a “clear near-term risk.” Hedge fund titan Ray Dalio, speaking in Davos at the end of January, also feared a global economic slowdown.

Goldman’s Hatzius, in a recent note reported by Bloomberg says:

Some green shoots are emerging that suggest that sequential growth will pick up from here.

Though the economist and his colleague Sven Jari Stehn believe Goldman’s global GDP growth forecast of 3.5% for 2019 is still at risk. The pair say global markets are “more sanguine on recession” and are bullish on risk assets and bond yields. They are also modestly so on oil but are bearish on dollar value. They also believe the US will lead the global pull back from the brink of recession, but that Europe could be the globe’s weak spot.

@GoldmanSachs Jan Hatzius says near-term recession risk is much lower than widely feared thanks to the Feds increased focus on financial conditions. One hike still expected for 2019. Do you agree? @jimcramer @KeithMcCullough @ReformedBroker @elerianm @ScottMinerd @TruthGundlach

— Goldman Advisor (@GoldmanAdvisor) February 15, 2019

Positive Major Indicators from the US Economy

US GDP is around 3%, unemployment is at its lowest for five decades, inflation is at 1.6% and income levels are growing at their fastest for ten years. US consumer confidence levels also rebounded in February from concerning numbers in January. The Conference Board confidence index rose to 131.4 from January’s 121.7. This, way above analysts’ expectations of around 124 points.

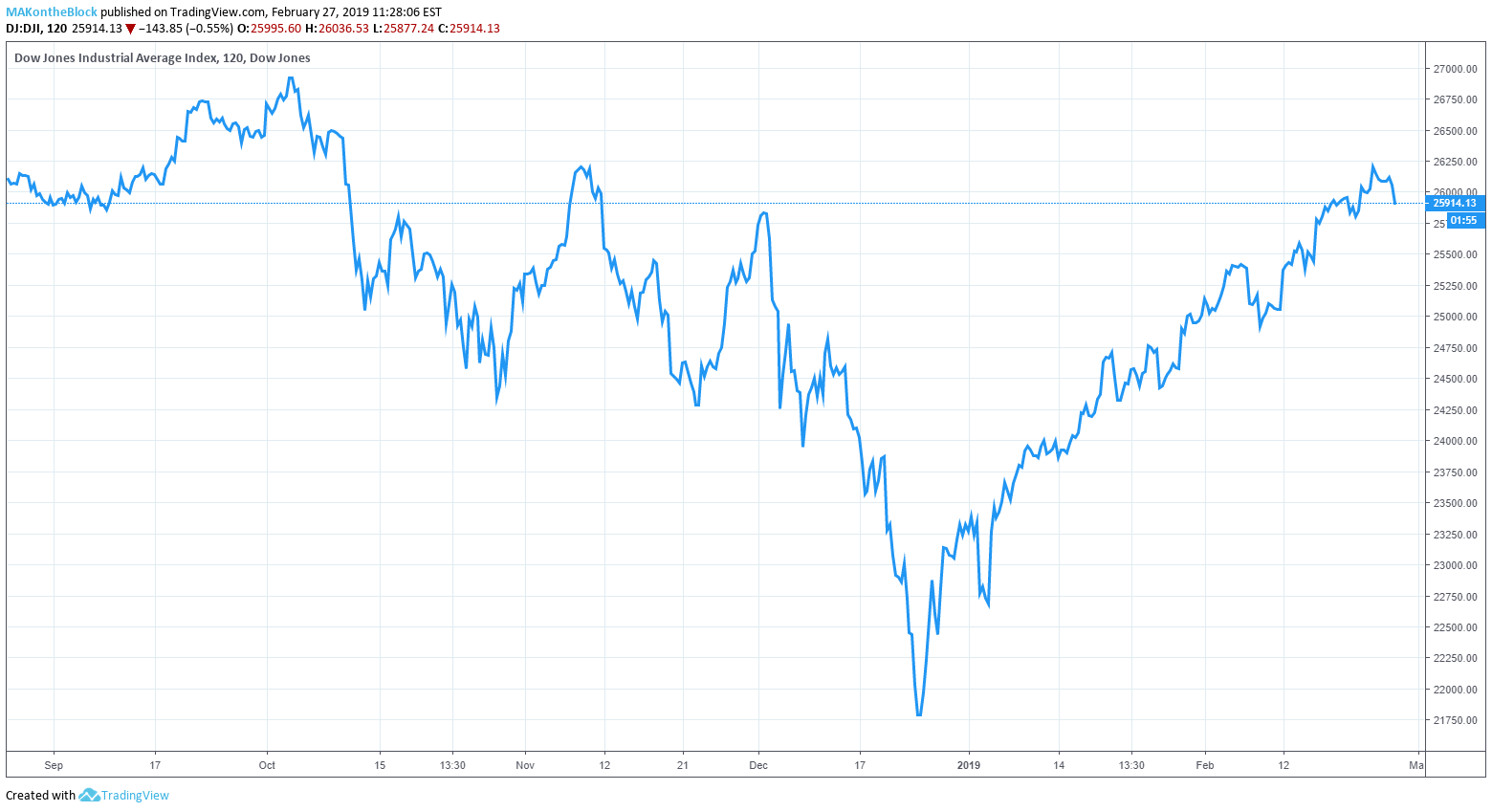

The US stock markets and Dow Jones Index have also seen a resounding recovery from December losses. Though some analysts believe recent equities performance could be a bear market rally.

A negative outcome from US-China trade talks threaten short term performance and long-term US national debt levels are concerning many.

Recession Risk Led by China and Europe

Though the US could well pull through and lead the charge away from a potential global economic recession, the biggest risks globally are from Europe and China.

China’s economy is already slowing and it’s the pace and accuracy of this slowdown that may influence global growth.

In Europe, Brexit hovers over both the UK and Europe. The economies of Germany, France, and Spain are slowing. China is also the EU’s second largest export market after the US. As always, the performance of global economies are deeply intertwined.

Question: Do you think the president has a grasp of macroeconomic policy?

Janet Yellen: No, I do not. https://t.co/IJlX7O6b61 pic.twitter.com/YaRXQrlgq3

— Nick Timiraos (@NickTimiraos) February 25, 2019

US President Donald Trump proclaims his economic success. But, critics believe he is one of the biggest risks to the US economy. And where the US goes the global economy may follow. Recession or growth. Economist David Stockman believes Trump is waging a four-faceted war on the US economy. Ex-Federal Reserve chair Janet Yellen doesn’t believe a recession is imminent either but has revealed obvious concerns about Trump’s macroeconomic expertise.